Investment plans

Investing through an investment plan allows you to achieve the fulfillment of long-term financial goals by making periodic payments. By simply choosing one or more investment funds, you can flexibly build your financial position. The investment plan facilitates the decision when to start investing, enables "entering the world" of investment funds without large financial burdens or initial capital, and supports the investor's decision/need for investment continuity

What do you achieve with the Investment Plan?

- Building a financial position. Regular monthly allocation reduces the amount available for immediate consumption, but consequently increases the amount for achieving your long-term goals.

- Acquiring the habit of regular investment. Initially, these are smaller amounts, which increase over time.

- Flexible investment management. At any time, you can cancel the order, change the amount, term or fund into which you are paying.

Which investment fund to choose?

- UCITS funds have different investment strategies and objectives, different fees and recommended investment periods. Before starting to invest, it is important to familiarize yourself with the possible risks characteristic of a particular fund.

- If you are not sure which fund best suits your needs, Zagrebačka banka provides the ZABA Smart Invest service through which it gives you a recommendation on how to allocate your financial resources in accordance with your personal goals and wishes and investment risk.

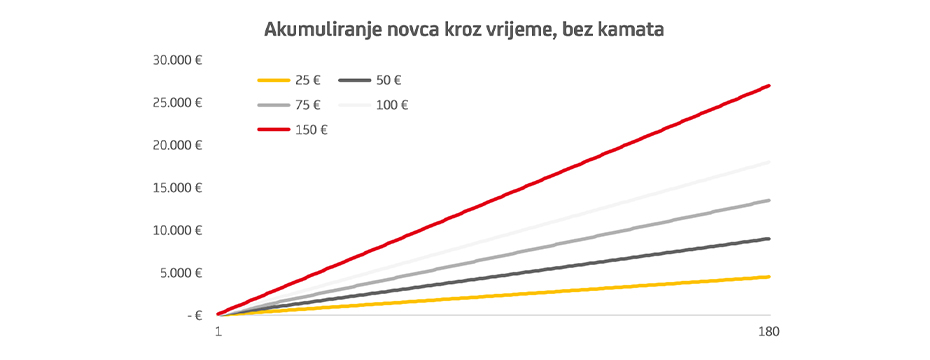

What amount to set aside?

- You determine the investment amount yourself, depending on your desired goals and needs.

Calculation of the possible investment value is available at: Calculator - My investment plan - Zagrebačka banka (zaba.hr)

In most cases, the reason or goal for which you start the Investment Plan also defines the investment horizon. For example, if you are saving for a more comfortable retirement, then you probably have ten or more years ahead of you; if you allocate for the university education of your children, then the investment horizon is ten years; if you dream of a big trip, then the horizon is 5-10 years; if you don't have a specific goal but you are aware that it is necessary to allocate funds monthly, then let time work for you and reward your decision to start the Investment Plan.

What to pay attention to?

- Using the average cost effect, you are able to reduce the impact of price volatility on the market with monthly payments, thus mitigating the risk of buying units in the fund at a time when the units are the most expensive.

How and where to start?

- You can arrange an investment plan free of charge at any branch office of Zagrebačka banka. You can also make use of the possibility of making an appointment at the branch at: Ugovaranje sastanka (zaba.hr)

How to monitor investment value?

- Through mobile banking (m-zaba)

- Through internet banking (e-zaba)

Interested links: